The 2026 tax filing season has officially started, and millions of Americans are watching closely to see how much they may receive in refunds. With everyday expenses still high, many households depend on their tax refund to manage bills, reduce debt, or strengthen savings. This year, attention has increased after the White House indicated that average refunds could rise by about $1,000 or more for many taxpayers.

When the IRS Started Accepting Returns

The Internal Revenue Service began accepting federal tax returns for the 2025 tax year on January 26, 2026. Anyone who paid more in federal income taxes than they owed during the year may be eligible for a refund. In addition, taxpayers with low or moderate incomes may qualify for refundable credits. These credits can provide money back even if the person did not owe federal income tax.

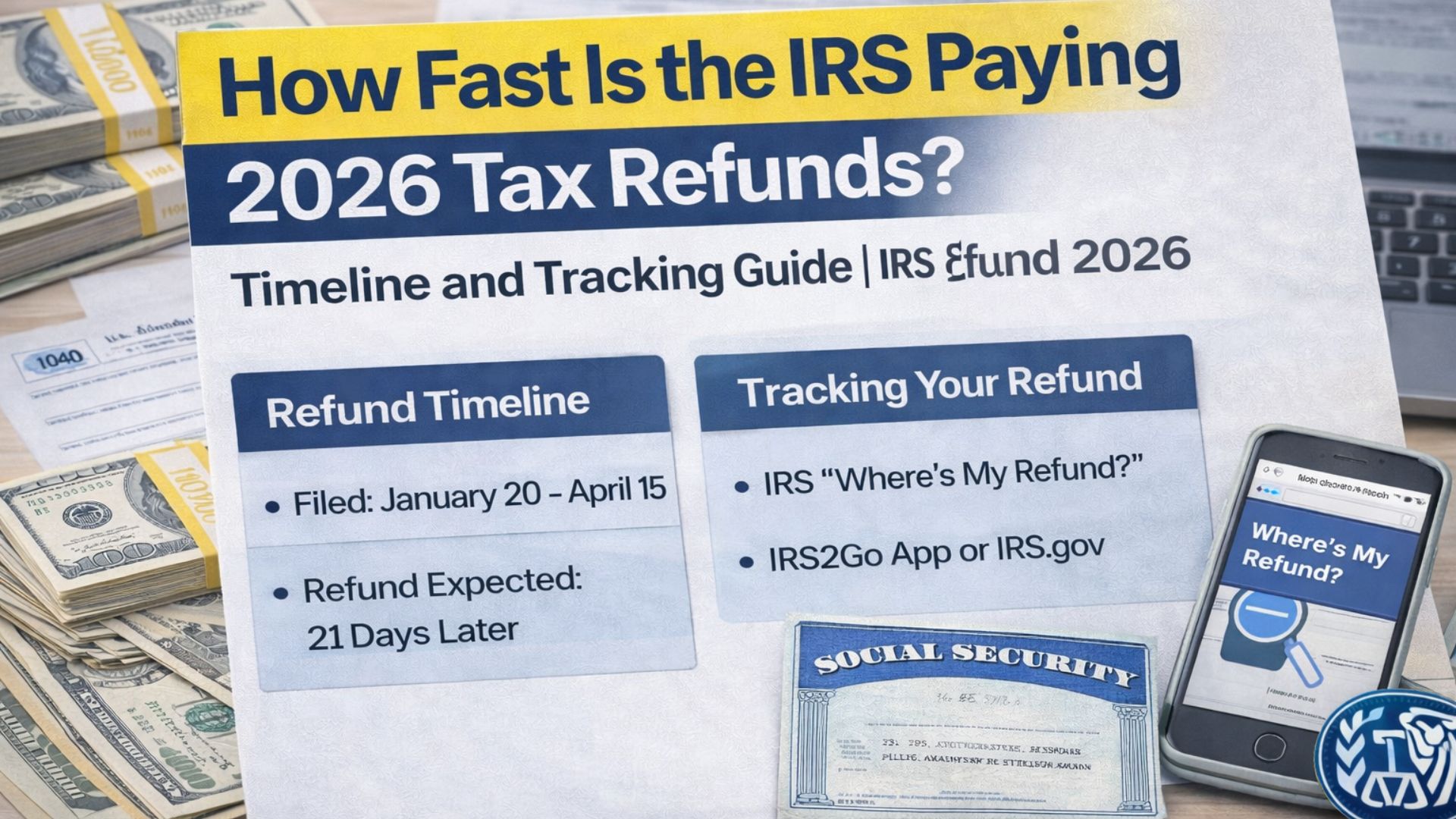

How Long Refunds Usually Take

The IRS states that taxpayers who file electronically and select direct deposit generally receive their refund within 21 days or less. This method remains the quickest way to get paid. Returns submitted on paper usually take longer because they must be processed manually. In some cases, refunds connected to paper filings may take four weeks or more, especially if a physical check is mailed.

Taxpayers claiming the Earned Income Tax Credit or the Additional Child Tax Credit should expect extra review time. The IRS has indicated that most of these refunds should arrive by early March, as additional checks are required before releasing the funds.

Why Some Refunds May Be Delayed

Although most returns are expected to move through the system without major problems, delays can still happen. Errors such as incorrect Social Security numbers, missing income documents, or calculation mistakes can slow down processing. Staffing challenges within the IRS may also contribute to occasional backlogs. Even so, the majority of taxpayers are likely to receive refunds within the standard time frame if their returns are accurate.

Changes That May Increase Refunds

Refund amounts may be higher this year due to recent tax law adjustments. The standard deduction has increased to $15,750 for single filers and $31,500 for married couples filing jointly. Taxpayers aged 65 and older receive an additional $6,000 deduction, which can lower taxable income further.

The Child Tax Credit has risen to $2,200 per child, and the Additional Child Tax Credit allows eligible families to receive up to $1,700 per child as a refundable amount. The Earned Income Tax Credit can also provide significant refunds, with a maximum benefit of $7,830 depending on income and family size.

Tracking Your Refund

Taxpayers can check the status of their refund using the official “Where’s My Refund?” tool on the IRS website. This system updates as returns move through processing and helps reduce uncertainty during tax season.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund amounts, eligibility rules, and timelines depend on individual tax situations and current IRS policies, which may change. Readers should consult official IRS resources or a qualified tax professional for guidance specific to their circumstances.