The 2026 tax filing season is now open, and millions of Americans are carefully reviewing their expected refund amounts. With everyday expenses such as housing, groceries, and insurance still placing pressure on family budgets, tax refunds continue to serve as an important financial cushion. Recent public statements have indicated that average refunds may rise for many taxpayers this year, which has increased interest and attention around the filing process.

Filing Season and Who May Qualify

The Internal Revenue Service officially began accepting returns on February 26, 2026. Anyone who had more federal income tax withheld from their paychecks than they actually owed may qualify for a refund. In addition, many lower and middle income households may receive money back through refundable tax credits. These credits can provide a refund even when no federal income tax is owed. Because of this, filing a return can still be beneficial for individuals with modest earnings.

How to Receive Your Refund Faster

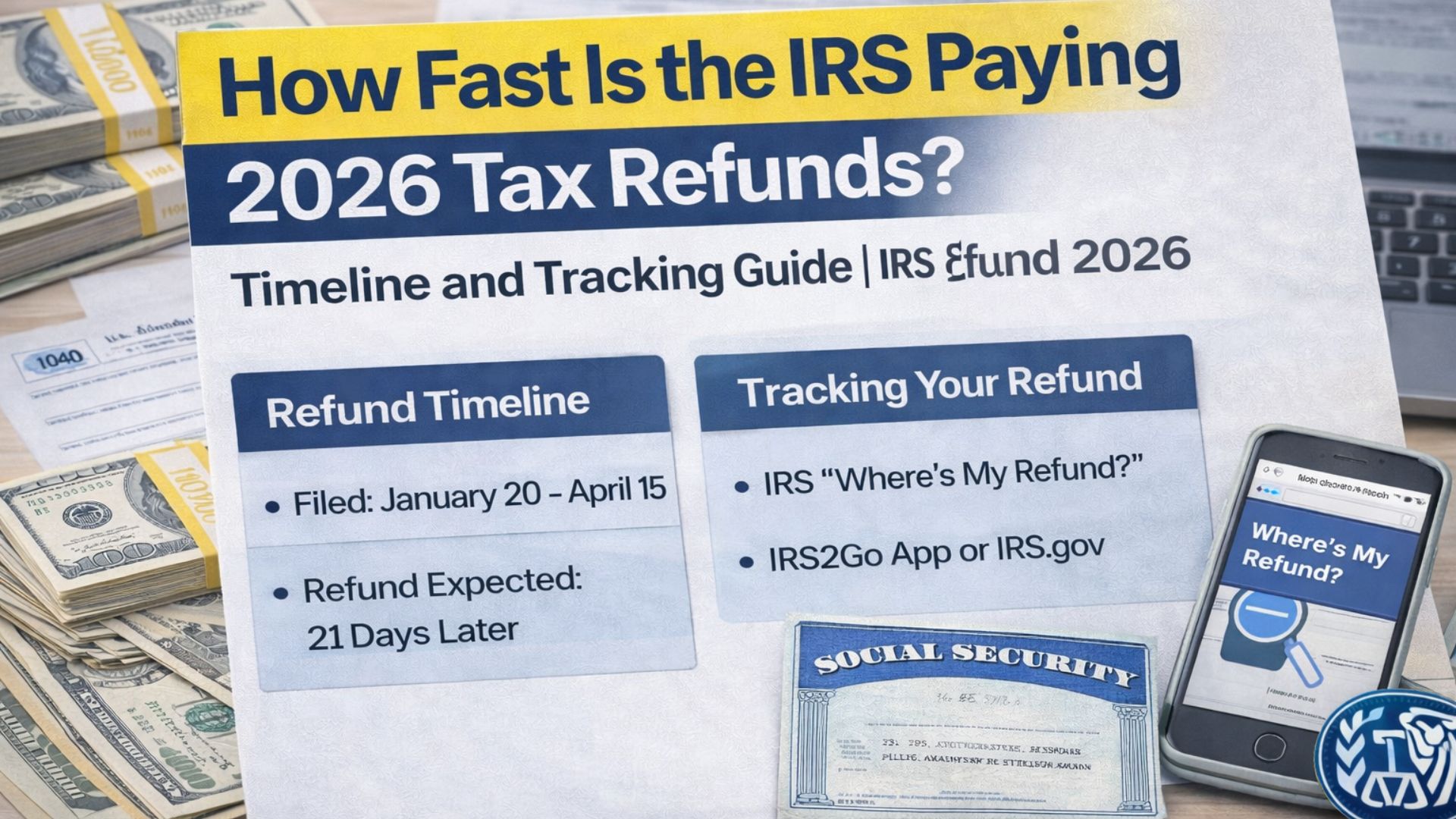

The IRS has confirmed that filing electronically and selecting direct deposit remains the quickest way to receive payment. Most electronic filers who choose direct deposit receive their refund within about 21 days after their return is accepted. Paper returns require manual handling, which can add several weeks to the processing time. If corrections are needed or a paper check must be mailed, the wait may extend to a month or longer.

Why Some Refunds May Be Delayed

Certain tax credits require additional review before refunds are released. Returns that include credits designed for working families are often held for verification. This extra review step helps prevent fraud and ensures eligibility rules are met. While most refunds move through the system smoothly, delays can occur due to staffing limits, incorrect personal details, missing forms, or calculation mistakes.

Changes That May Affect Refund Amounts

Recent tax law updates have increased the standard deduction. Single filers can now claim a larger deduction, while married couples filing jointly receive an even higher combined amount. Taxpayers aged 65 or older may also claim an additional deduction, which can reduce taxable income and potentially increase refunds.

Taxpayers can monitor their refund progress through the official IRS online tracking tool, which provides updates during each stage of processing.

Disclaimer: This article is for informational purposes only and does not provide tax, financial, or legal advice. Refund amounts, eligibility, and timelines vary based on individual circumstances and official IRS rules. For accurate and personalized guidance, consult official IRS resources or a qualified tax professional.