An income tax refund is the amount returned to you when the tax you paid during the year is more than your actual tax liability. For many salaried individuals and small business owners in India, this refund feels like financial relief. It may help with household expenses, loan payments, school fees, or savings plans. However, confusion about refund timelines and status updates often causes unnecessary stress.

Under the Income Tax Act, 1961, if your total tax paid through Tax Deducted at Source, advance tax, or self-assessment tax is higher than your final tax calculation, the extra amount is refunded by the Income Tax Department. This process is now mostly digital and handled through the official e-filing portal. Even though the system is faster than before, errors and delays can still happen.

Refunds usually arise when deductions and exemptions reduce your taxable income. Many taxpayers claim benefits under Sections 80C and 80D, or exemptions like House Rent Allowance. Sometimes employers deduct tax on the safer side, which leads to excess payment. In such cases, when you file your Income Tax Return and calculate the correct tax, the difference becomes refundable.

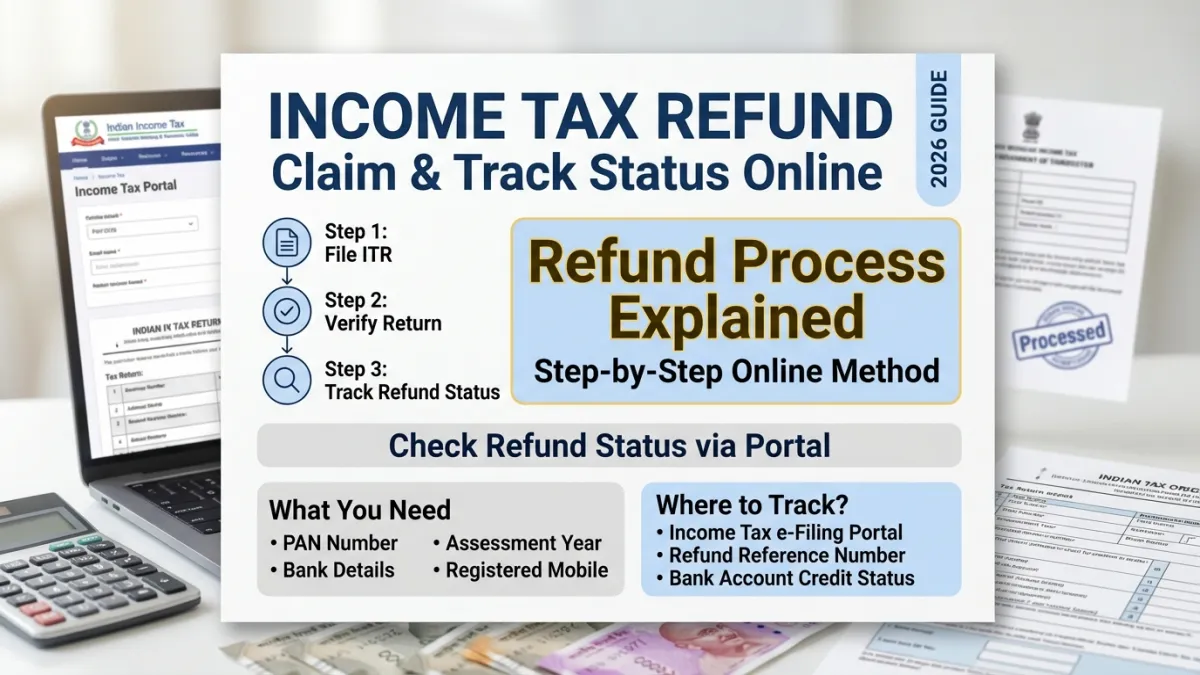

There is no separate form required to request a refund. Once you file your ITR under Section 139 and verify it electronically or through the Centralised Processing Centre, the system automatically checks whether a refund is due. If everything matches, the return is processed under Section 143(1), and the refund is issued.

The amount is usually credited directly to your pre-validated bank account using electronic transfer methods. It is important that your bank details are correct and linked with your PAN. If the account number or IFSC code is wrong, the refund may fail, causing further delay.

You can track your refund status by logging into the income tax e-filing portal. Common status messages include Under Processing, Refund Issued, Refund Failure, or Demand Determined. Under Processing means the return is being reviewed. Refund Failure often indicates incorrect bank details. Demand Determined means additional tax is payable instead of a refund.

In most cases, refunds are processed within 20 to 45 days after successful verification of the ITR. During busy filing seasons, the timeline may be slightly longer. If the refund is delayed beyond a reasonable period, the department may pay interest under Section 244A. On the other hand, if an excess refund was issued by mistake, it can be recovered under Section 234D.

To avoid delays, always verify your return on time and carefully check Form 16, Form 26AS, and the Annual Information Statement before filing. Accurate information ensures faster processing and fewer complications.

Disclaimer: This article is for informational purposes only and does not provide financial, legal, or tax advice. Tax rules and refund procedures may change under the Income Tax Act, 1961. For updated information and personal guidance, consult the official Income Tax Department website or a qualified tax professional.