The first round of Social Security payments for 2026 will arrive next week, and many beneficiaries are closely watching their bank accounts. With the new cost of living adjustment now active and possible Medicare premium updates, recipients want to understand how their monthly payment may look different from last year. Even small changes can affect budgeting for retirees and individuals who depend on these benefits.

Understanding the Monthly Payment Schedule

The Social Security Administration uses a structured system to send payments each month. People who started receiving benefits before May 1997 usually receive their deposit at the beginning of the month. Others are paid according to their birth date. Payments are typically sent on the second, third, or fourth Wednesday of the month depending on when the recipient was born. Checking the official payment calendar helps confirm the exact deposit date.

How the 2026 Cost of Living Adjustment Works

The 2026 cost of living adjustment has already been added to monthly benefit amounts. This adjustment is designed to help benefits keep pace with rising prices. The increase is applied automatically and is based on a percentage. Because it is percentage based, individuals with higher monthly benefits will see a larger dollar increase than those with lower benefits. Even though the increase may appear modest, it can make a difference over the course of the year.

Impact of Medicare Premium Deductions

While gross benefit amounts may rise, Medicare Part B premiums are often deducted directly from Social Security payments. If Medicare premiums increase in 2026, some of the benefit increase may be reduced by higher deductions. Beneficiaries should compare the total benefit amount with the final amount deposited into their bank account. Reviewing the updated benefit notice can clarify how the adjustment and deductions affect the net payment.

Important Steps for Beneficiaries

Recipients should confirm their payment date, review the updated benefit statement, and ensure the new adjustment has been applied correctly. Any unexpected difference between the expected and actual deposit should be reported to the Social Security Administration. Most beneficiaries do not need to re enroll, but changes in income or work activity should always be reported to avoid complications.

Planning for the Year Ahead

The first payment of 2026 helps set the monthly budget for the year. Understanding how the cost of living increase and Medicare deductions work together allows beneficiaries to plan more confidently.

Disclaimer: This article is for informational purposes only and does not provide legal or financial advice. Individual benefit amounts and payment dates may vary based on personal circumstances and official Social Security Administration policies.

यह भी पढ़े:

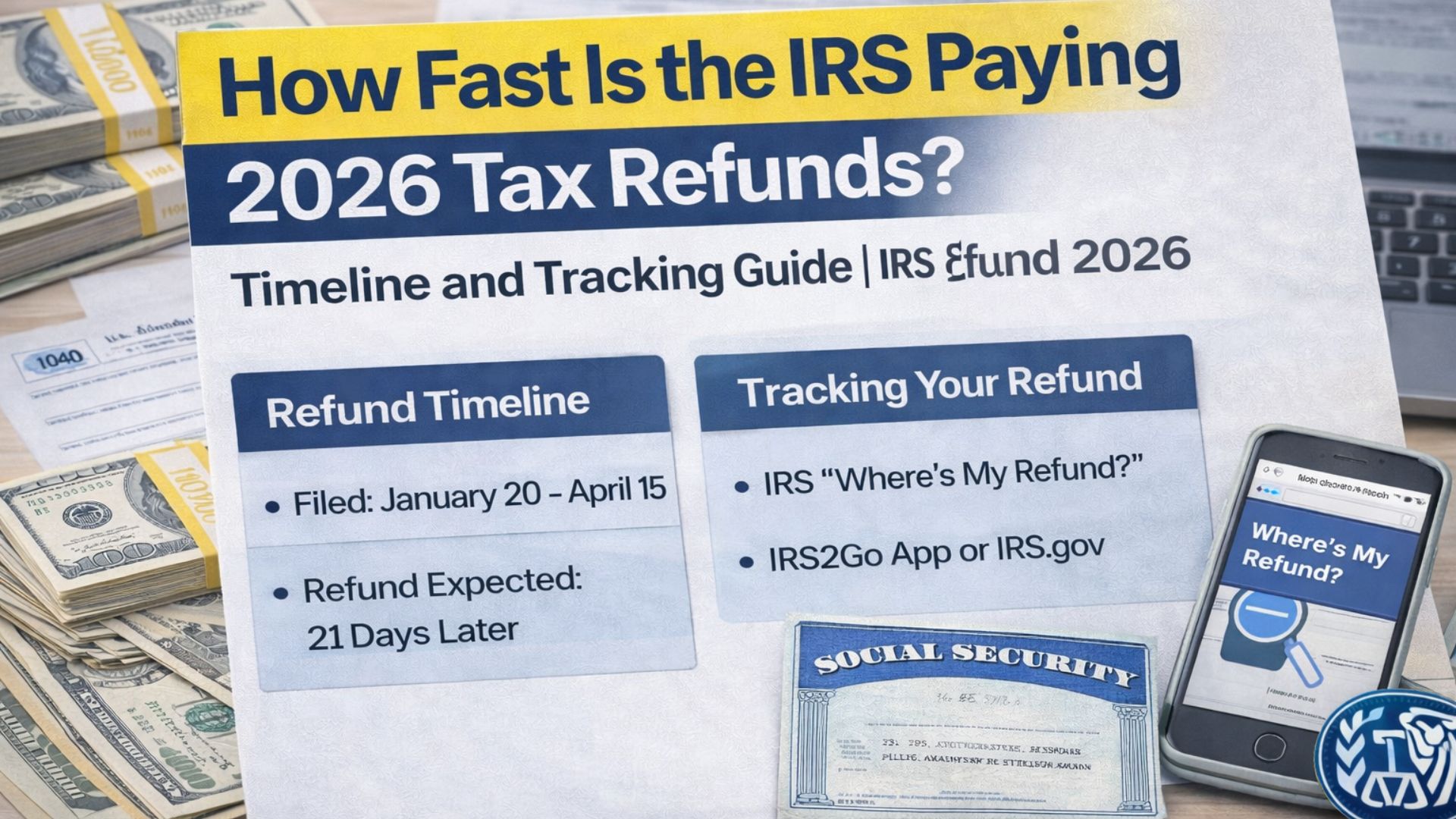

IRS Tax Refund 2026: What to Expect

IRS Tax Refund 2026: What to Expect