As the 2026 tax season approaches, many Americans are asking the same question: when will their tax refund arrive? For many households, a refund is not just extra money. It is often used to pay rent, cover medical bills, reduce credit card balances, or rebuild savings. Understanding how the IRS refund schedule works can help reduce uncertainty and allow better financial planning.

When the IRS Will Start Accepting Returns

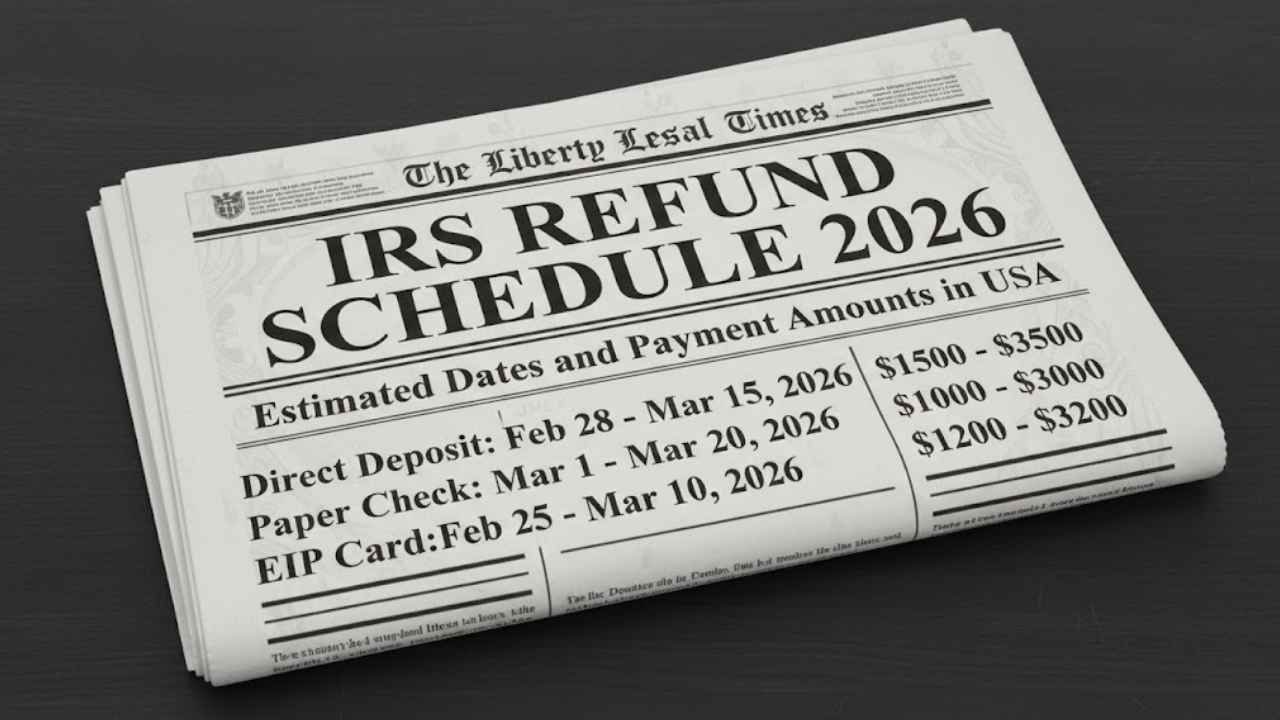

Tax refunds issued in 2026 will be based on income earned during the 2025 tax year. The Internal Revenue Service is expected to begin accepting electronic returns in late January 2026, with January 27 widely expected as the opening day. Any returns submitted before the official opening date will be held and processed once the system becomes active. Filing early is helpful, but refunds cannot be released until processing officially begins.

How Long Refunds Usually Take

For taxpayers who file electronically and select direct deposit, refunds are generally issued within 10 to 21 days after the IRS accepts the return. Many people receive their refunds closer to the two-week range if their returns are simple and accurate. Electronic filing combined with direct deposit remains the fastest and safest way to receive funds.

Paper returns take longer because they must be manually reviewed and entered into IRS systems. If a refund is sent by paper check, additional mailing time must also be considered. This can add several weeks to the overall timeline.

Special Delays for Certain Tax Credits

Each year, some refunds are legally delayed. Returns that claim the Earned Income Tax Credit or the Additional Child Tax Credit cannot be released until mid-February. For the 2026 season, these refunds are expected to begin arriving around February 18. This delay applies to all eligible filers and is designed to prevent fraud and protect taxpayers.

Factors That Affect Refund Amounts and Timing

Refund amounts are different for every taxpayer. Income level, tax withholding, number of dependents, and available credits all influence the final amount. A smaller refund does not necessarily mean higher taxes. It may simply indicate that withholding during the year was more accurate.

Errors are one of the most common reasons for delays. Incorrect Social Security numbers, wrong bank details, missing forms, or mismatched income records can trigger additional review. Identity verification requests and amended returns can also extend processing time.

Taxpayers can check their refund status using the official IRS “Where’s My Refund?” tool or the IRS2Go mobile app. These tools update daily and show when a return has been received, approved, and sent.

Overall, the 2026 IRS refund schedule follows familiar patterns. Filing electronically, choosing direct deposit, and reviewing information carefully are the best ways to receive a refund smoothly.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund timing and eligibility depend on individual tax situations and official IRS rules. Readers should consult official IRS resources or a qualified tax professional for guidance specific to their circumstances.