The 2026 tax season in the United States has moved into a key period, and many taxpayers are closely watching their refund status. For most households, a tax refund is not extra spending money. It is often used for practical needs such as paying heating and electricity bills, covering rent or mortgage payments, reducing credit card balances, or managing medical expenses. With living costs still high, the timing of a refund can make a real difference in monthly budgeting.

Why February Is an Important Month

February is usually the first month when a large number of refunds are issued. This is because many people file their tax returns as soon as the season opens. Early filers often have simple tax situations, such as salaried employees, retirees, or families claiming common tax credits. In 2026, many taxpayers submitted their returns in late January to receive their refunds as soon as possible. Based on past trends, a large share of refunds is typically sent between mid-February and the end of the month.

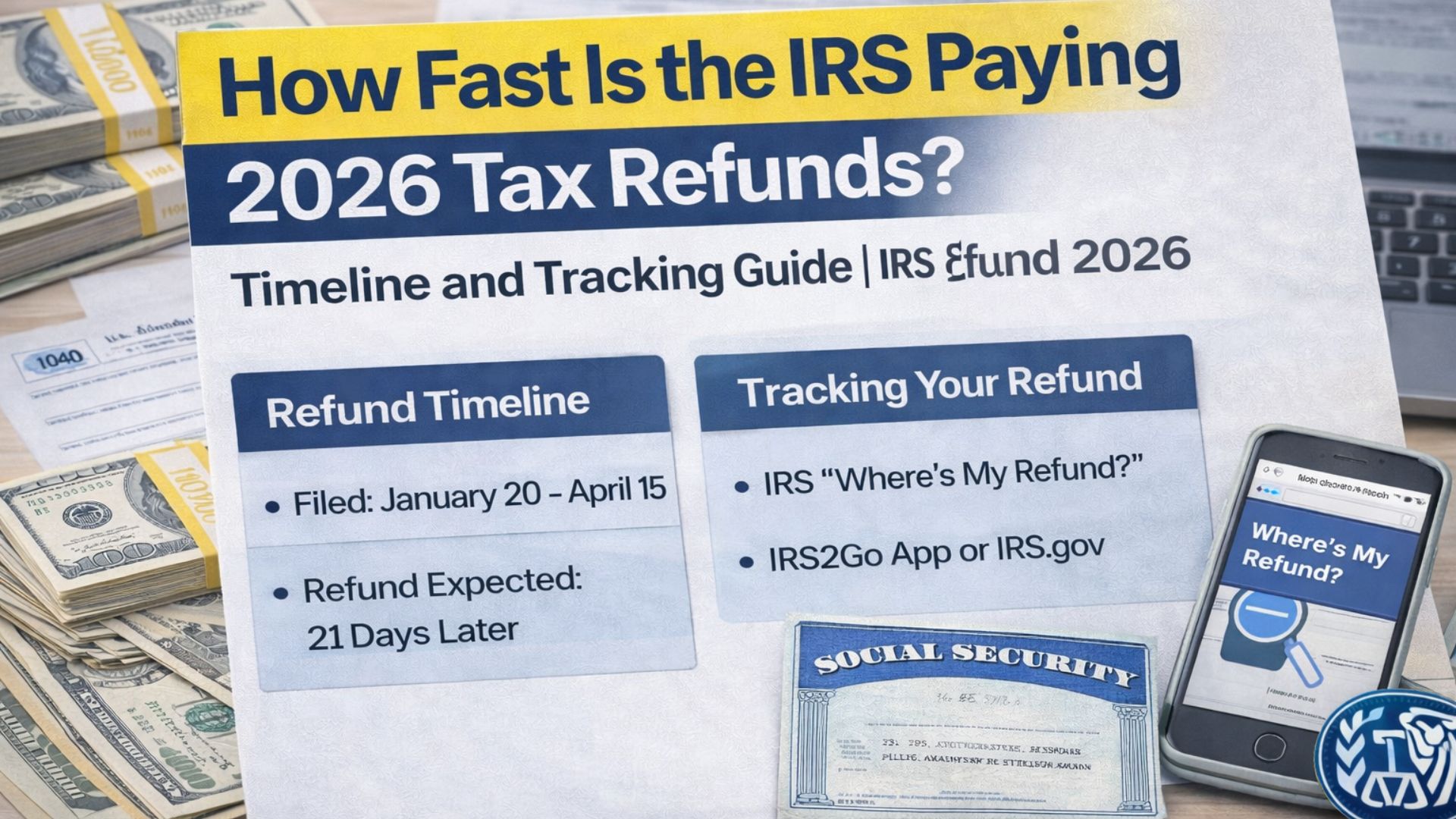

How the Refund Process Works

After a tax return is filed electronically and accepted, it moves into an automated system operated by the Internal Revenue Service. This system checks reported income, tax credits, and withholding details against information provided by employers and financial institutions. If everything matches correctly, the refund is approved and scheduled for payment. Taxpayers who choose direct deposit usually receive their refunds faster than those who request paper checks.

Electronic Filing vs Paper Returns

Electronic filing is generally the fastest way to receive a refund. Paper returns require manual handling, which can slow down processing. Even small errors, such as missing information or simple calculation mistakes, may cause delays. For this reason, the IRS continues to recommend electronic filing combined with direct deposit as the safest and quickest option.

Reasons for Possible Delays

Some returns may take longer to process. Returns that include refundable credits or complex financial details often go through additional review steps. These reviews are routine and are meant to prevent mistakes and fraud. Returns with mismatched income information or unresolved issues from previous years may also require manual review. Responding quickly to any IRS request for more information can help reduce waiting time.

Financial Importance of Refunds

For many families, February refunds provide essential financial relief. They help manage winter bills, reduce debt, and stabilize household budgets. When refunds are delayed, some households may rely more on credit, which can increase financial stress. Refund money also supports local businesses as it is spent within communities.

Disclaimer

यह भी पढ़े:

IRS Tax Refund 2026: What to Expect

IRS Tax Refund 2026: What to Expect

This article is for informational purposes only and is based on general IRS procedures and historical refund patterns. Actual refund dates may vary depending on individual tax situations and IRS processing requirements. Taxpayers should refer to official IRS resources or consult a qualified tax professional for advice specific to their situation.